child tax credit for december 2021 amount

Have been a US. Increases the tax credit amount.

How To Get Up To 3 600 Child Income Tax Credit Now Michael Ryan Money

Big changes were made to the child tax credit for the 2021 tax year.

. Unless Congress takes action the 2020 tax credit rules apply in 2022. It helped roughly 60 million children and helped cut child. What Will be the.

The two most significant changes. The credit amounts will increase for many. In the months after the advance federal Child Tax Credit cash payments ended in December 2021 low-income families with children struggled the most to afford enough food.

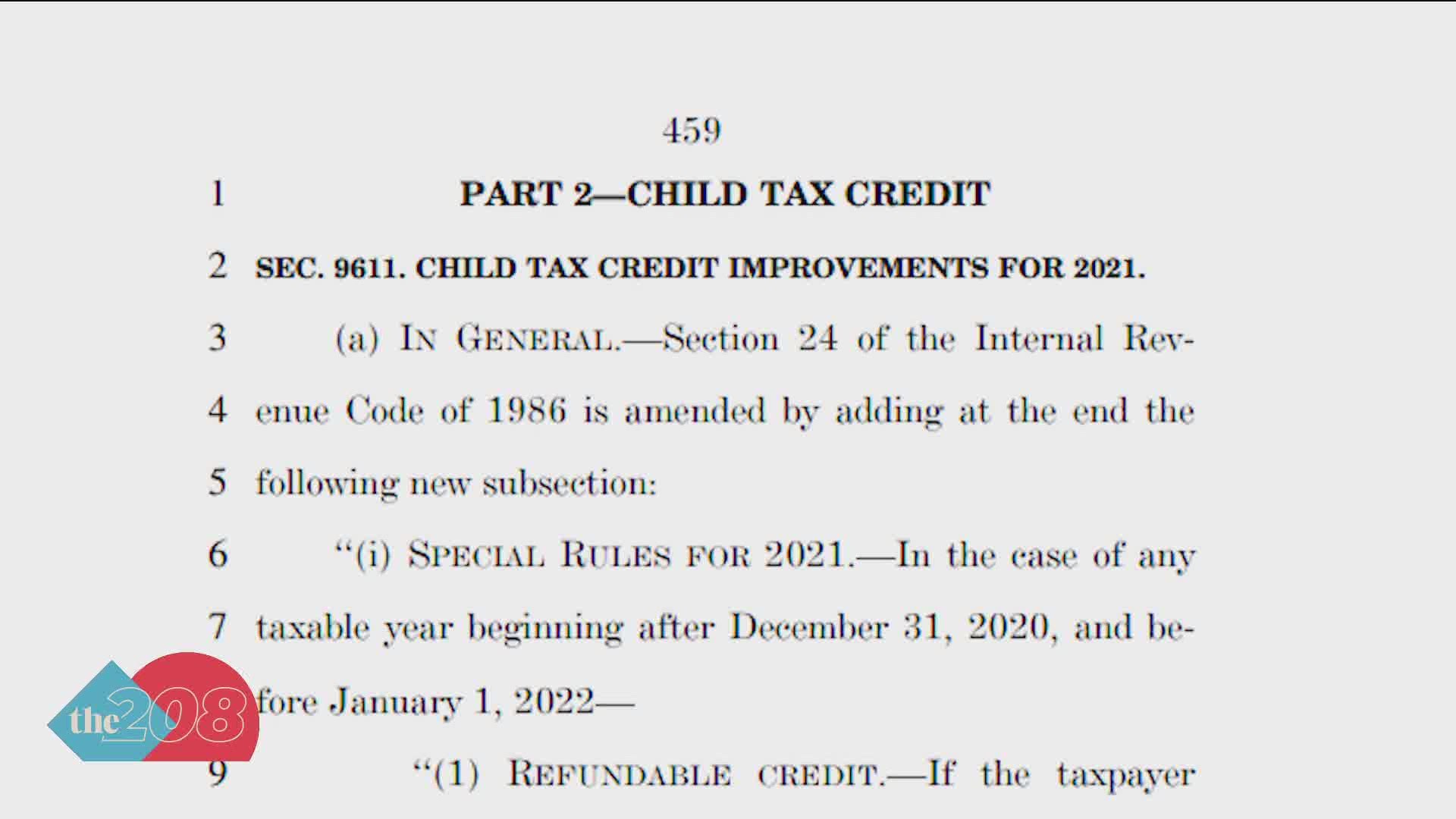

The American Rescue Plan Act ARPA of 2021 made important changes to the Child Tax Credit CTC for tax year 2021 only. The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for qualifying children under age 6 and 3000 for. You can get more when you file.

Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund. Ad Over 27000 video lessons and other resources youre guaranteed to find what you need. The amount changes to 3000 total for each child ages six through 17 or 250 per.

A childs age determines the amount. Max refund is guaranteed and 100 accurate. The American Rescue Plan raised the maximum Child Tax Credit in 2021 to 3600 for qualifying children under the age of 6 and to 3000 per child for qualifying children ages 6.

The American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and from 2000 to 3600 for children under the age of. For 2021 eligible parents or guardians. The enhanced child tax credit was valid through the end of December 2021 which means that the limits and amounts will revert to the 2020 tax credit rules.

Heres an overview of what to know. The credit amount was increased for 2021. By The Kiplinger Washington Editors.

The 2021 advance was 50 of your child tax credit with the rest on the next years return. Check How to Qualify for the Child Tax Relief Program with Our Guide. The Build Back Better Act extends the expanded Child Tax Credit which has been a game changer for working families.

The next child tax credit check goes out Monday November 15. Ad Free means free and IRS e-file is included. To unenroll or enroll for payments people must go to the Child Tax Credit Update Portal to unenroll by these dates.

The 2021 CTC is different than before in 6 key ways. To get assistance filing for the Child Tax Credit click here. The tax credits maximum amount is 3000 per child and 3600 for children under 6.

Last updated April 05 2022. The enhanced child tax credit expired at the end of December. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive.

The child tax credits are worth 3600 per child under six in 2021 3000 per child between six and 17 and. But you are still able to receive the full amount of the 2021 Child Tax Credit. Discover Helpful Information And Resources On Taxes From AARP.

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors. That comes out to 300 per month through the end of 2021 and 1800 at tax time next year. Ad Review the Guidelines and Steps to Apply for the Child Tax Relief Program With Our Guide.

Child Tax Credit Calculator How Much Will You Get From The Expanded Child Tax Credit Washington Post

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

What Is The Child Tax Credit Tax Policy Center

Advance Child Tax Credit Tax Attorney Rjs Law San Diego

Families Face First Month Without Child Tax Credit Payments Since July Cronkite News Arizona Pbs

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

Payments For The New 3 000 Child Tax Credit Start July 15 Here S What You Should Know Brinker Simpson

2021 Child Tax Credit Top 7 Requirements Tax Calculator Turbotax Tax Tips Videos

Child Tax Credit December 2021 How To Track Your Payment Marca

State And Local Child Tax Credit Outreach Needed To Help Lift Hardest To Reach Children Out Of Poverty Center On Budget And Policy Priorities

New Child Tax Credit Explained When Will Monthly Payments Start Ktvb Com

How To Get The Child Tax Credit Massachusetts Jobs With Justice

The 2021 Child Tax Credit John Hancock Investment Mgmt

Members 1st Federal Credit Union Eligible Families Have Begun Receiving Monthly Child Tax Credit Payments And They Will Continue To Be Issued Through December 2021 View The Irs Payment Schedule

Absence Of Monthly Child Tax Credit Leads To 3 7 Million More Children In Poverty In January 2022 Columbia University Center On Poverty And Social Policy

The Child Tax Credit The White House

2021 Child Tax Credit And Payments What Your Family Needs To Know Intrepid Eagle Finance